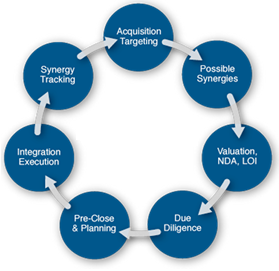

OUR APPROACH

Based on our analysis and years of experience—including more than 10,000 M&A-related projects across a wide range of industries and geographies—our mergers and acquisitions experts believe that the key to successful M&A is a repeatable model; one that companies can return to over and over again to reap substantial rewards.

The virtuous cycle for M&A begins by building a strong M&A capability that forms the foundation for the success of the model’s key steps:

-

Corporate strategy and acquisition strategy: Develop a clearly articulated strategy and an M&A plan that reinforces that strategy. Strategy is FMI Acquisitions Inc´s heritage; with more than 15 years of experience helping companies develop time-tested strategies, we understand the types of deals that create value and those that don’t.

-

Deal thesis: Invest with a thesis. Successful deals are guided by a meaningful deal thesis that is tied to a firm’s growth strategy and that spells out how the deal will add value both to the target and acquiring company.

-

Strategic due diligence: Ask and answer the big questions. The best acquirers investigate targets with a nose for what’s really important, identifying the key sources of ongoing value and sniffing out any “perfumed pigs” buffed up for sale. A frequent acquirer knows exactly where it can add value and is therefore able to set its own price—and to walk away if the price isn’t right.

-

Merger integration planning: Integrate where it matters. No two integrations are the same, and companies must carefully consider aspects from culture to IT in order to realize the full value of the deal.

-

Merger integration execution: Nail the short list of critical actions. Merging two companies requires rigorous follow-through on a long list of integration tasks, large and small. Doing both is hard. Part of the answer lies in a few, powerful guiding principles: tailor the integration thesis to the deal thesis; integrate where it matters; and act with deliberate speed.